Debunking the Fear of a Housing Market Crash

Recently, I came across an interesting article from Current Matters that sheds light on some common misconceptions about the housing market. In this post, I'll be summarizing the key points of the article to help clear up any confusion and provide accurate information.

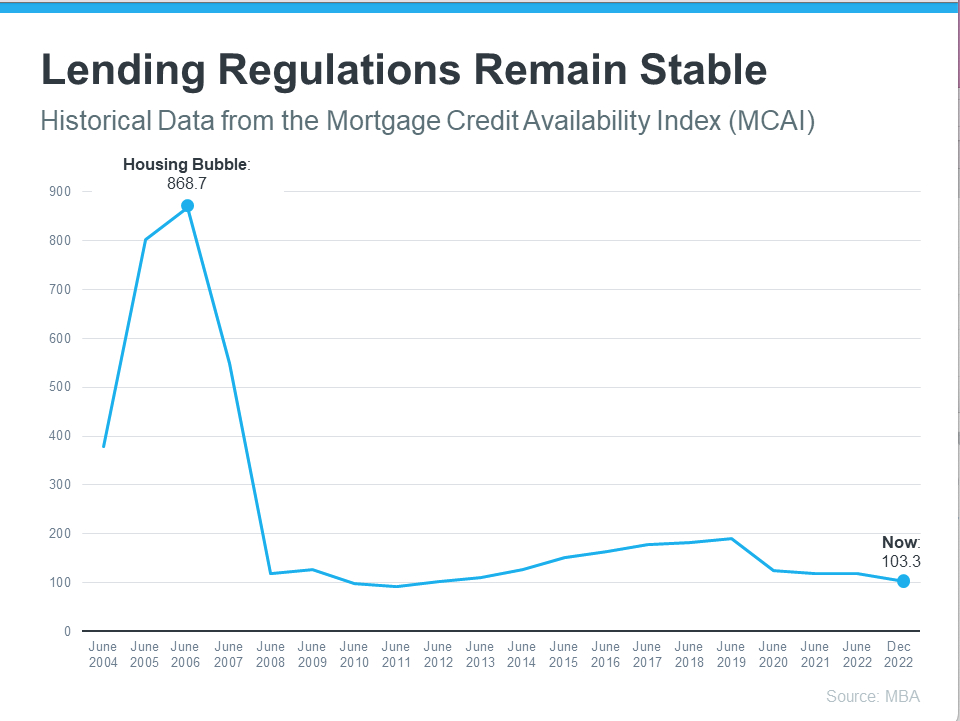

According to recent reports, 67% of Americans are concerned about an imminent housing market crash in the next three years. However, the current housing market data suggests that today's market is different from what it was during the housing market crash in 2008. During that time, banks lowered their lending standards, allowing almost anyone to qualify for a home loan or refinance their existing one. This created artificial demand, which led to mass defaults, foreclosures, and falling prices.

Today, the lending standards are much stricter, and purchasers face much higher standards from mortgage companies. A graph based on data s from the Mortgage Bankers Association shows how things have changed. The higher the index number, the easier it is to get a mortgage, while the lower the number, the harder it is. The graph clearly shows that things are different today, and tighter lending standards have prevented a situation that could lead to a wave of foreclosures like the last time.

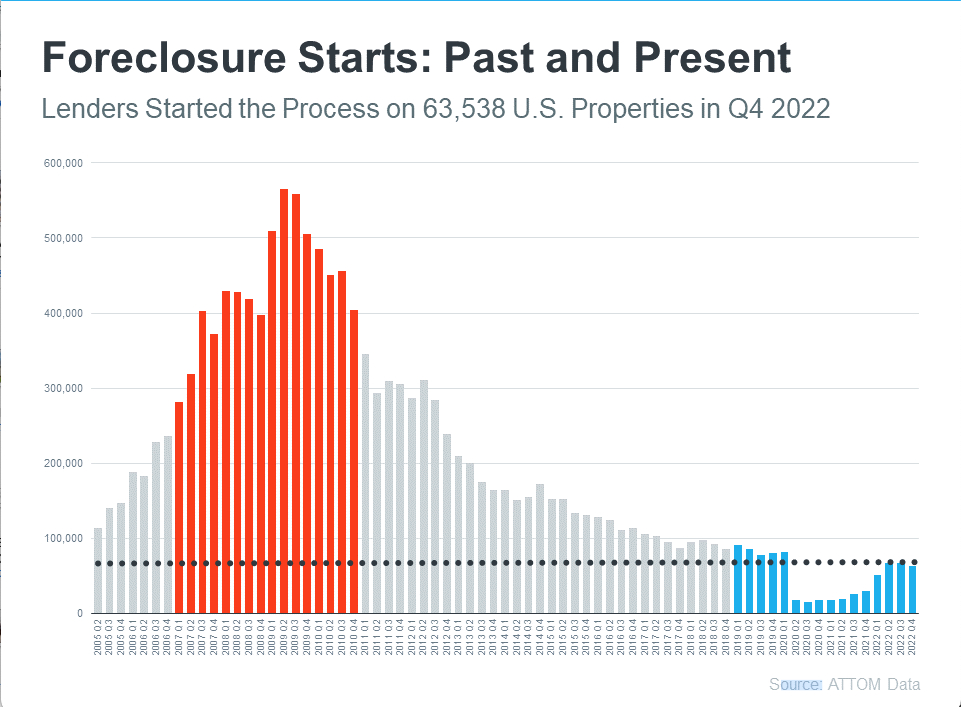

The number of homeowners facing foreclosure has declined significantly since the last crash. The reason for this is that buyers today are more qualified and less likely to default on their loans. Although the number of foreclosures has increased slightly, the total number is still very low. Experts also do not expect a drastic increase in foreclosures like the ones that occurred after the last housing bubble.

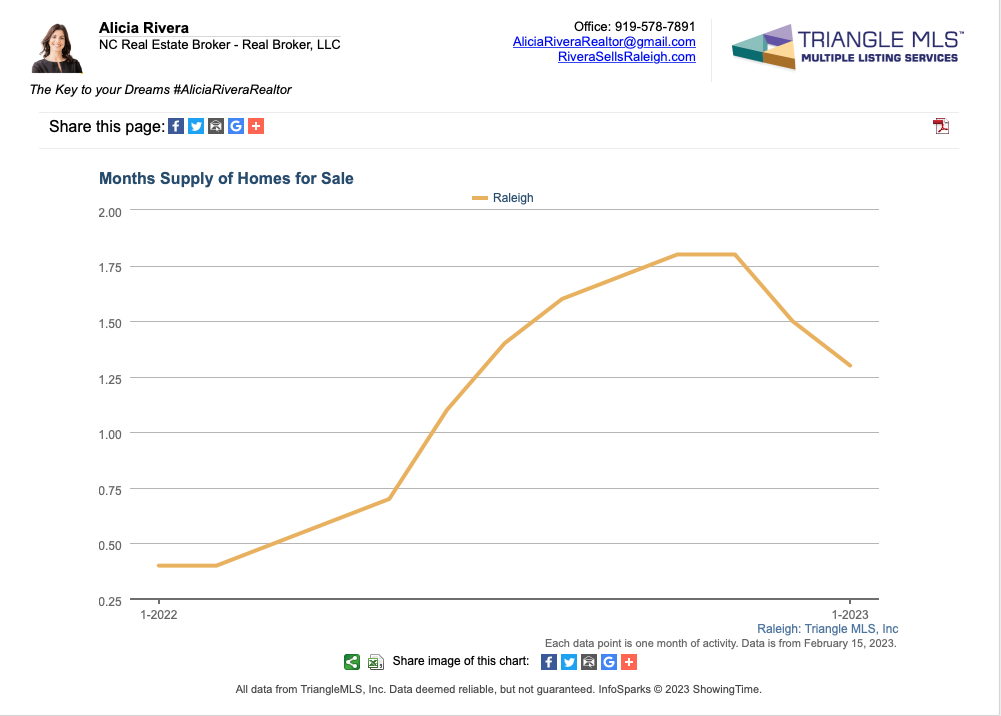

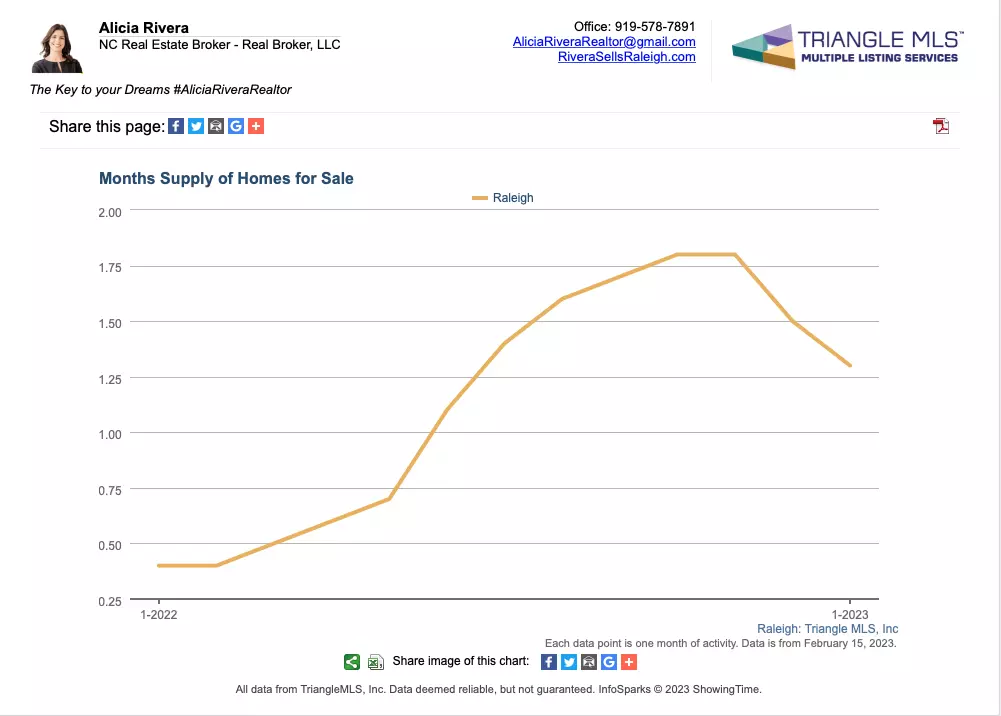

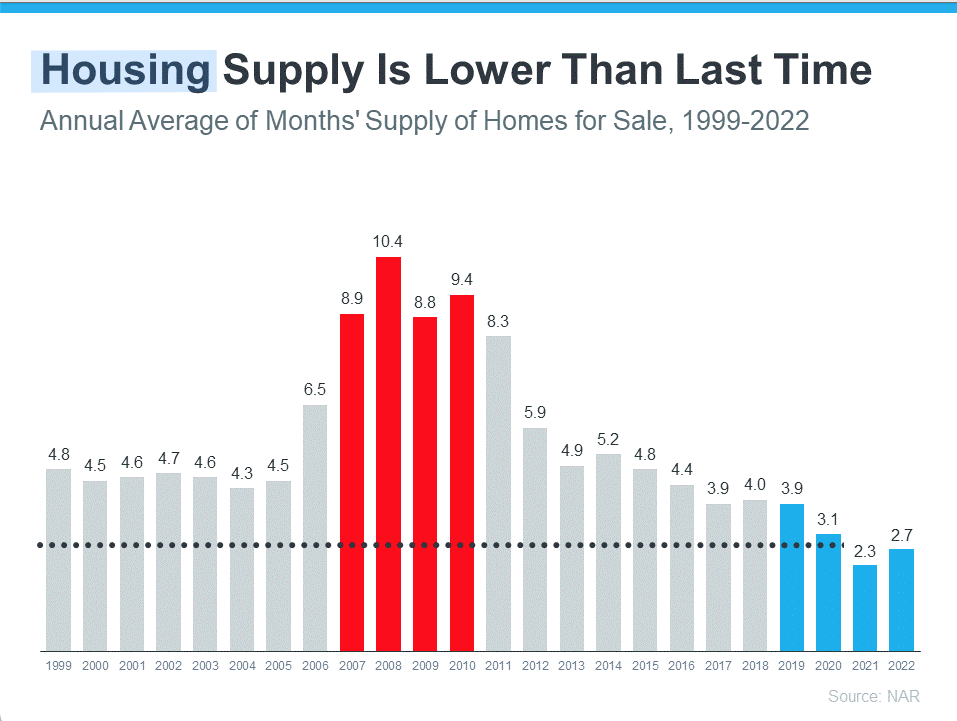

There were too many homes for sale during the housing crisis, which caused prices to fall dramatically. However, the supply of homes for sale today is limited, and there is still a shortage of inventory available overall, mainly due to years of underbuilding homes. But, the current unsold inventory sits at just 2.7-months' supply (national average) and 1.3-months' supply (Raleigh-Jan.TMLS) at the current sales pace, which is significantly lower than the last time. This means that there isn't enough inventory on the market for home prices to come crashing down like they did last time.

The picture above is live, click on it for current months' supply info for Raleigh, NC

It is essential to keep in mind that the data mentioned above should ease fears about another housing market crash. The current market is nothing like the last time, and experts have predicted that the situation is unlikely to repeat. Therefore, it is important to inform people who are concerned and not fully informed on the facts, as the current data provides reasons to be optimistic about the housing market.

If you want to more about this subject, what all of this means for you as a buyer or seller, or just want to know the value of your home in this market. Schedule a call with me https://calendly.com/aliciariverarealtor or click here for a free home valuation.

Alicia Rivera/Realtor/Real Broker, LLC

Images sourced from Current Matters

Categories

Recent Posts

GET MORE INFORMATION

5960 Fairview Rd Suite 400, Charlotte, NC, 28210, United States